An educational loan can be used for various purposes, including tuition fees, textbooks, educational materials, living expenses, study abroad programs, and even professional certification courses. It provides you with the flexibility to invest in your education and achieve your academic goals.

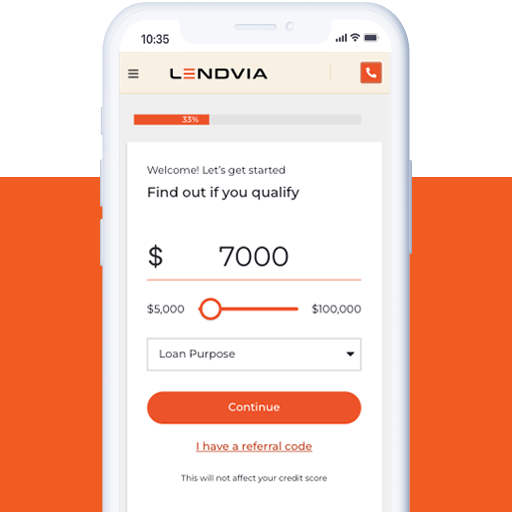

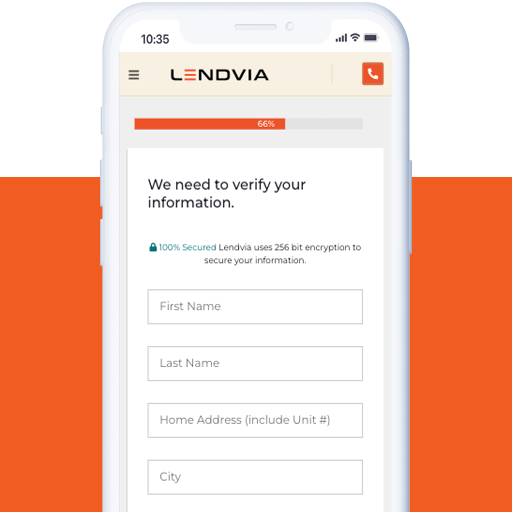

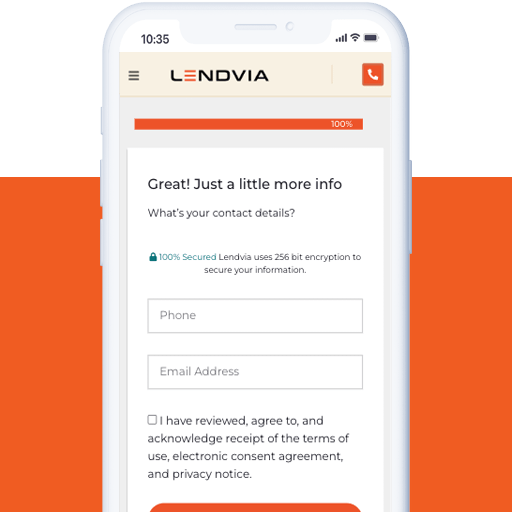

The educational loan application process at Lendvia is simple and straightforward. Start by filling out an online application form, and one of our Loan Coaches will guide you through the process. You’ll be asked to provide information about your educational background, financial situation, and personal details. Once approved, you’ll receive your funds, and you can start using them to support your education.

The time it takes to receive funds from an educational loan can vary. At Lendvia, we strive to provide a fast and efficient process. In some cases, you may receive the funds as quickly as 1 business day after approval. Our goal is to provide timely financial support when you need it most for your education.

Lendvia takes a comprehensive approach to evaluating loan applications. While credit history is considered, we also take into account factors such as your educational background and employment status. We believe in providing opportunities to all individuals, so don’t hesitate to apply even if you have less-than-perfect credit.

Yes, you can pay off your educational loan early with Lendvia. We encourage responsible financial management, and there are no prepayment penalties or fees for paying off your loan ahead of schedule. By doing so, you can save on interest and potentially free up funds for further educational pursuits.

Lendvia’s educational loans have an origination fee, which covers the costs of processing and servicing the loan. The fee is deducted from the loan amount at the beginning, and all terms and fees will be clearly disclosed to you before accepting the loan. We believe in transparency and want you to have a clear understanding of the costs involved.