Achieve your financial goals with Lendvia. Learn more!

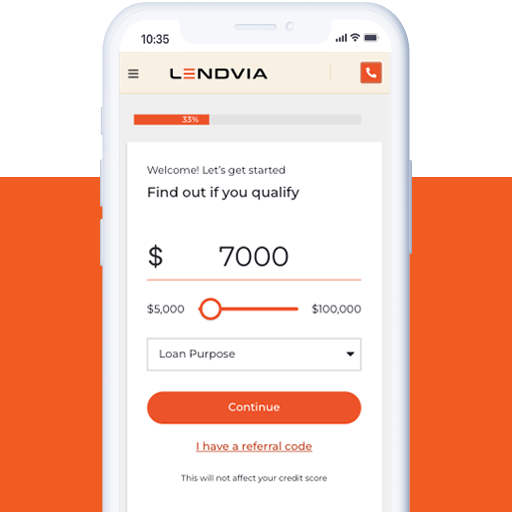

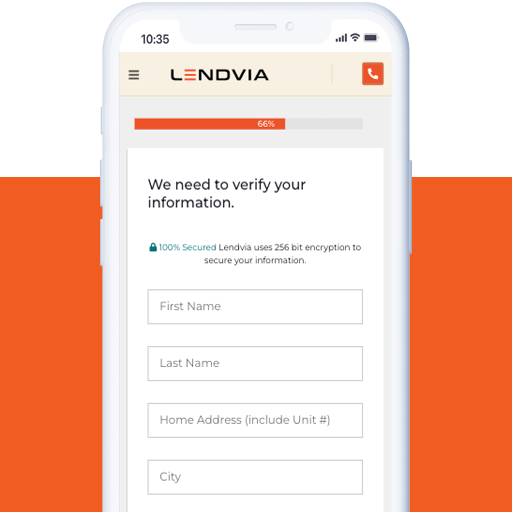

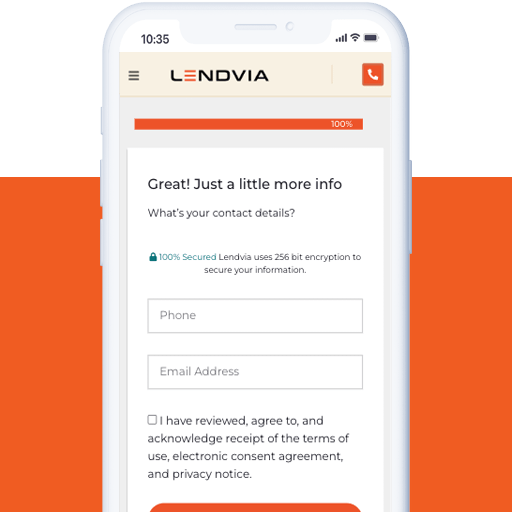

Our application process is designed with you in mind, plus, you can speak to a friendly team who will assist you in completing the application.

Our team will guide you through the process, to understand your options and choose the offer that aligns with your needs.

With Lendvia’s loan consolidation options, you can simplify your repayment process and regain control over your finances.

To get started, fill out the form with your basic information. Let us know the best time for us to contact you. We respect your time and will make sure our loan specialists are available when it’s most convenient for you.

A consolidation loan allows you to combine multiple credit cards and my loan into one loan with a lower interest rate and a single monthly payment. It simplifies your financial management and can potentially save you money on interest payments.

By consolidating your loans, you can reduce your monthly payment, save on interest charges, and have a clear repayment plan. It helps you regain control over your finances and simplifies your debt management.

In some cases, you may be able to include other debts, such as credit cards or unsecured loans, in your loan consolidation program. It’s best to consult with your specialist to determine the eligibility and terms.

The length of time to pay off your unsecured loan depends on factors such as the loan amount, interest rate, and your repayment plan. With a well-structured consolidation loan, you can typically pay off your unsecured debt faster compared to making minimum payments on multiple loans.

Lendvia’s credit card consolidation loans have an origination fee, which covers the costs of processing and servicing the loan. The fee is deducted from the loan amount at the beginning, and all terms and fees will be disclosed to you before accepting the loan.

A credit card consolidation loan is a personal loan specifically tailored to help you tackle and eliminate credit card debt. When you opt for a consolidation loan, you use the funds to pay off your high-interest credit card balances.

This way, you can say goodbye to exorbitant interest rates and say hello to a single loan with a more manageable interest rate. Plus, you’ll enjoy the convenience of making one monthly payment towards your loan until you reach your payoff date.

At Lendvia, you can borrow between $1,000 and $50,000 with our credit card consolidation loans. The specific loan amount you qualify for depends on various factors, including your creditworthiness and financial profile.

No, checking your rate with Lendvia will not impact your credit score. We perform a soft credit inquiry to provide you with personalized rates and options without any negative effect on your credit history.

Lendvia believes in transparency. We charge an origination fee, which covers the costs of processing and servicing your loan. This fee is included in your loan amount, and all terms and fees will be clearly disclosed to you before accepting the loan. We aim to provide you with a clear understanding of the costs involved.